Recent Images

Chapter Iv D Of Income Tax Act 1961

Us 92c2 of it act 1961 computation of arms length price price va. This has been defined in section 245 to mean the total amount of income referred to in section 5 computed in the manner laid down.

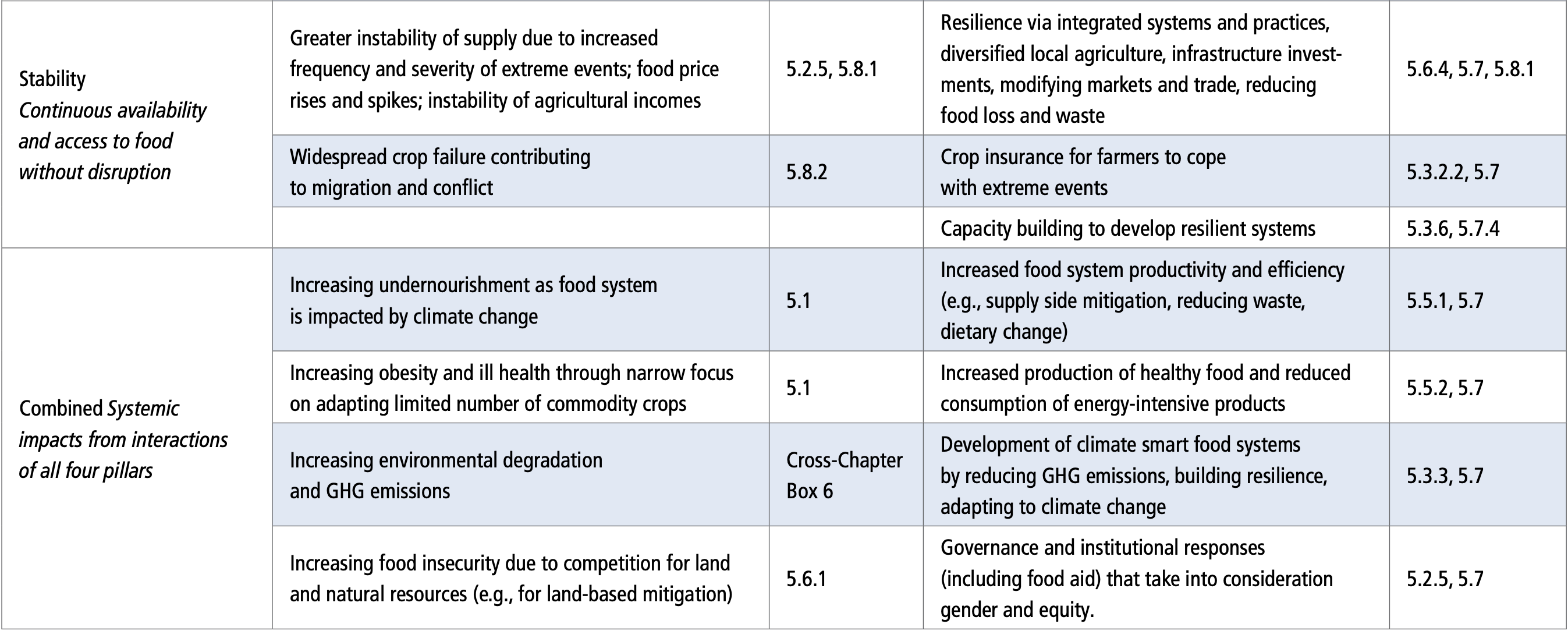

Chapter 5 Food Security Special Report On Climate Change And Land

Valuation required under the provisions of the companies act 2013 and.

Chapter iv d of income tax act 1961. Notwithstanding anything contained in section 24 any interest chargeable under this act which is payable outside india not being interest on a loan issued for public subscription before the 1st day of april 1938 on which tax has not been paid or deducted under chapter xvii b and in respect of which there is no person in india who may be treated as an agent under section 163 shall not be deducted in computing the income chargeable under the head income from house property. Can anybody explain to me in short the provisions of chapter iv d of the income tax act 1961. Subject matter of charge to income tax under the provisions of the income tax act 1961 is total income.

Measures to enhance ipr ecosystem through lower fees. Salary perquisite and profits in lieu of salary defined. The income tax act 1961 provides that ao is required to make a correct assessment of the total income or loss of the assessee and determine correct amount of tax or refund as the case may be.

Income tax act 1961 arrangement of sections section chapter i page preliminary 1. Computation of total income heads of income. Home acts rules income tax act income tax act 1961 part d profits and gains of business or profession chapters list this profits and gains of business or profession income tax act 1961.

Scope of total income 131 5a. Short title extent and commencement 11 2. Expenditure incurred in relation to income not includible in total income.

Defined in different contexts and the subject matter of charge is not the income but the total income. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Charge of income tax 130 5.

Residence in india 132 7. Section80r deduction in respect of remuneration from certain foreign sources in the case of professors teachers etc. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail.

Commerce ministry through ecgc raises insurance cover for banks up to. Previous year defined 130 chapter ii basis of charge 4. Apportionment of income between spouses governed by portuguese civil code 132 6.

Chapter iv in the income tax act 1961 deals with the topiccomputation of total income. Section80rr deduction in respect of professional income from foreign sources in certain cases section80rra deduction in respect of remuneration received for services rendered outside india. Cci online learning caclubindia online learning offers a wide variety of online classes and video lectures for various professional courses such as ca cs cma cisa as well as various certification courses on gst transfer pricing international.

Appendix D Technical Appendixes To Select Chapters A Roadmap To

Https Publications Tnsosfiles Com Rules Filings 06 20 19 Pdf

Exhibit101shareissuancea

Http Libres Uncg Edu Ir Uncg F Wertz Delores 1963 Pdf

Http Www Arkleg State Ar Us Assembly 2019 Summary 20budget 20manuals 2018taxhandbook Pdf

2

2

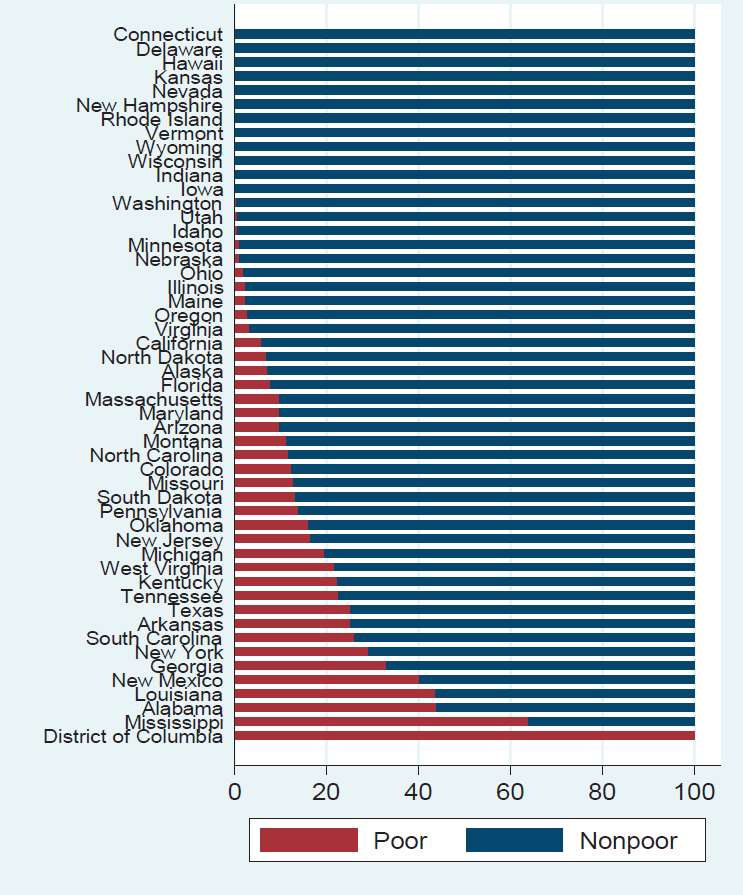

Pdf The Financial Crisis And Income Distribution In Korea The

On Display Gi Bill Of Rights Pieces Of History