Recent Images

Chapter Iv F Of Income Tax Act 1961

Measures to enhance ipr ecosystem through lower fees. Subject matter of charge to income tax under the provisions of the income tax act 1961 is total income.

How To Calculate Income Tax How To Compute Your Total Taxable Income

Provided further that where the total income of an associated enterprise is computed under this sub section on determination of the arms length price paid to another associated enterprise from which tax has been deducted 7 or was deductible under the provisions of chapter xviib the income of the other associated enterprise shall not be recomputed by reason of such determination of arms length price in the case of the first mentioned enterprise.

Chapter iv f of income tax act 1961. Fincome from other sources 56. Profits chargeable to tax. The assessee appellant is a partnership firm within the meaning of indian partnership act 1932 and is regularly assessed to tax under the income tax act 1961 hereinafter referred to as the said act.

Chapter iv in the income tax act 1961 deals with the topiccomputation of total income. Commerce ministry through ecgc raises insurance cover for banks up to. Eligible and ineligible units under the same head are aggregated in accordance with the provisions of section 70 of the act.

Defined in different contexts and the subject matter of charge is not the income but the total income. 35cca expenditure by way of payment to associations and institutions for carrying out rural development programmes. Income from other sources.

Valuation required under the provisions of the companies act 2013 and. 52 the income computed under various heads of income in accordance with the provisions of chapter iv of the it act shall be aggregated in accordance with the provisions of chapter vi of the it act 1961. Chapter iv14 to 59 34 conditions for depreciation allowance and development rebate.

The appellant assessee had filed the returns for the previous years relevant to assessment years 1995 96 to 1998 99. This means that first the incomeloss from various sources ie. Transfer irrevocable for a specified period.

54c capital gain on transfer of jewellery held for personal use not to be charged in certain cases omitted. Transfer of income where there is no transfer of assets. Section 167b2ii of the income tax act 1961 provides that any member or members thereof is or are chargeable to tax at a rate or rates which is or are higher than the maximum marginal rate tax shall be charged on that portion or portions of the total income of the association or body which is.

This has been defined in section 245 to mean the total amount of income referred to in section 5 computed in the manner laid down. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Revocable transfer of assets.

4 the provisions of sections 44aa and 44ab shall not apply in so far as they relate to the business referred to in sub section 1 and in computing the monetary limits under those sections the total turnover or as the case may be the income from the said business shall be excluded. Us 92c2 of it act 1961 computation of arms length price price va. Chapter v income of other persons included in assessees total income 60.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail.

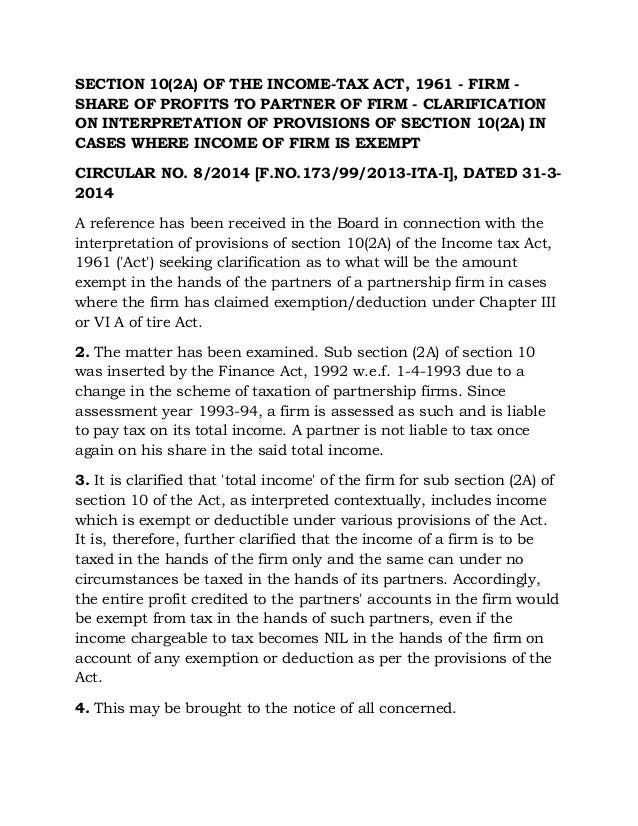

Partners Aren T Liable To Pay Tax On Income Which Is Exempt In Hands

Heads Of Income Tax Under Income Tax Act 1961 Capital Gains Tax

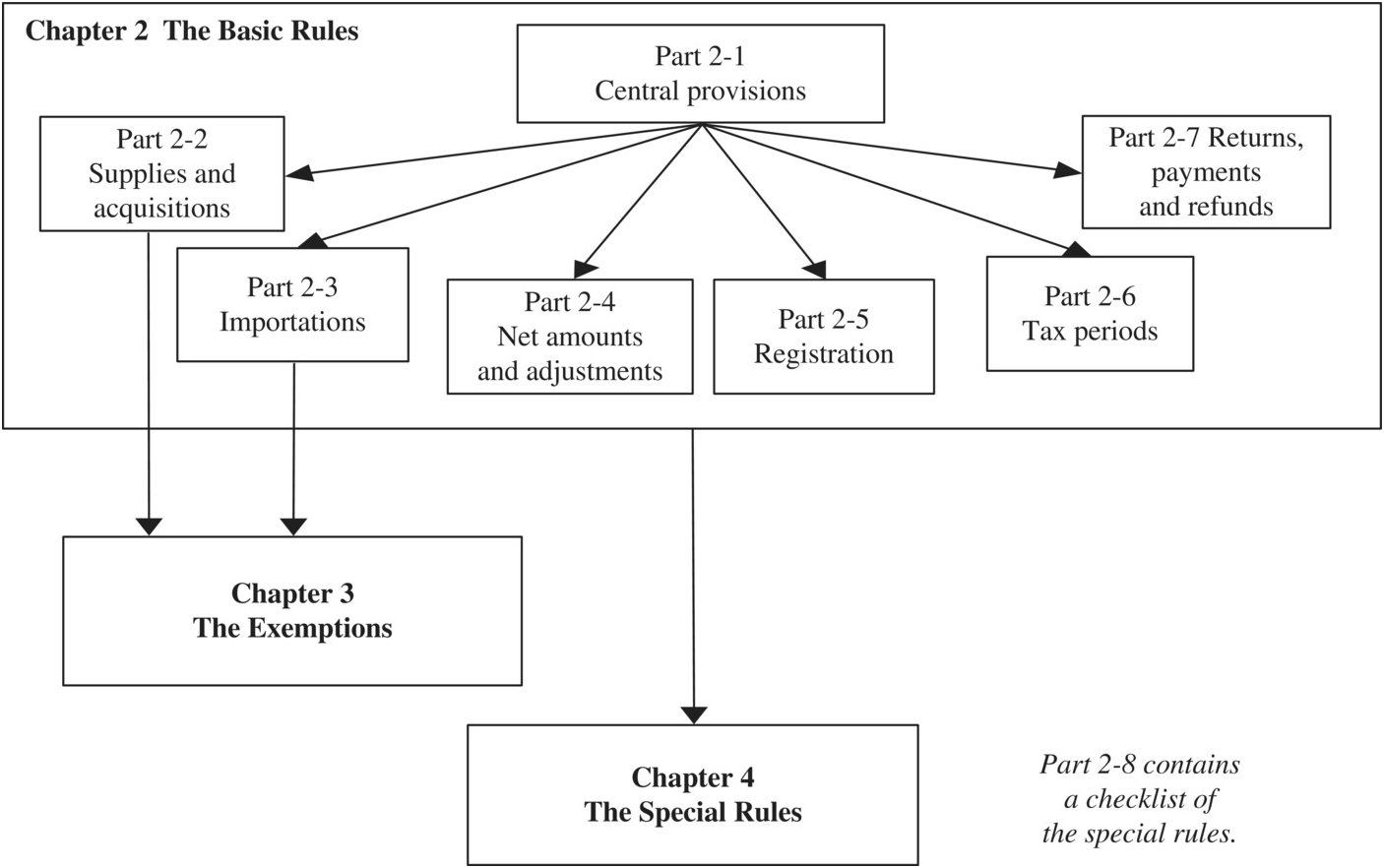

Case Studies On The Real World Challenges Of Vat Reform Part Iii

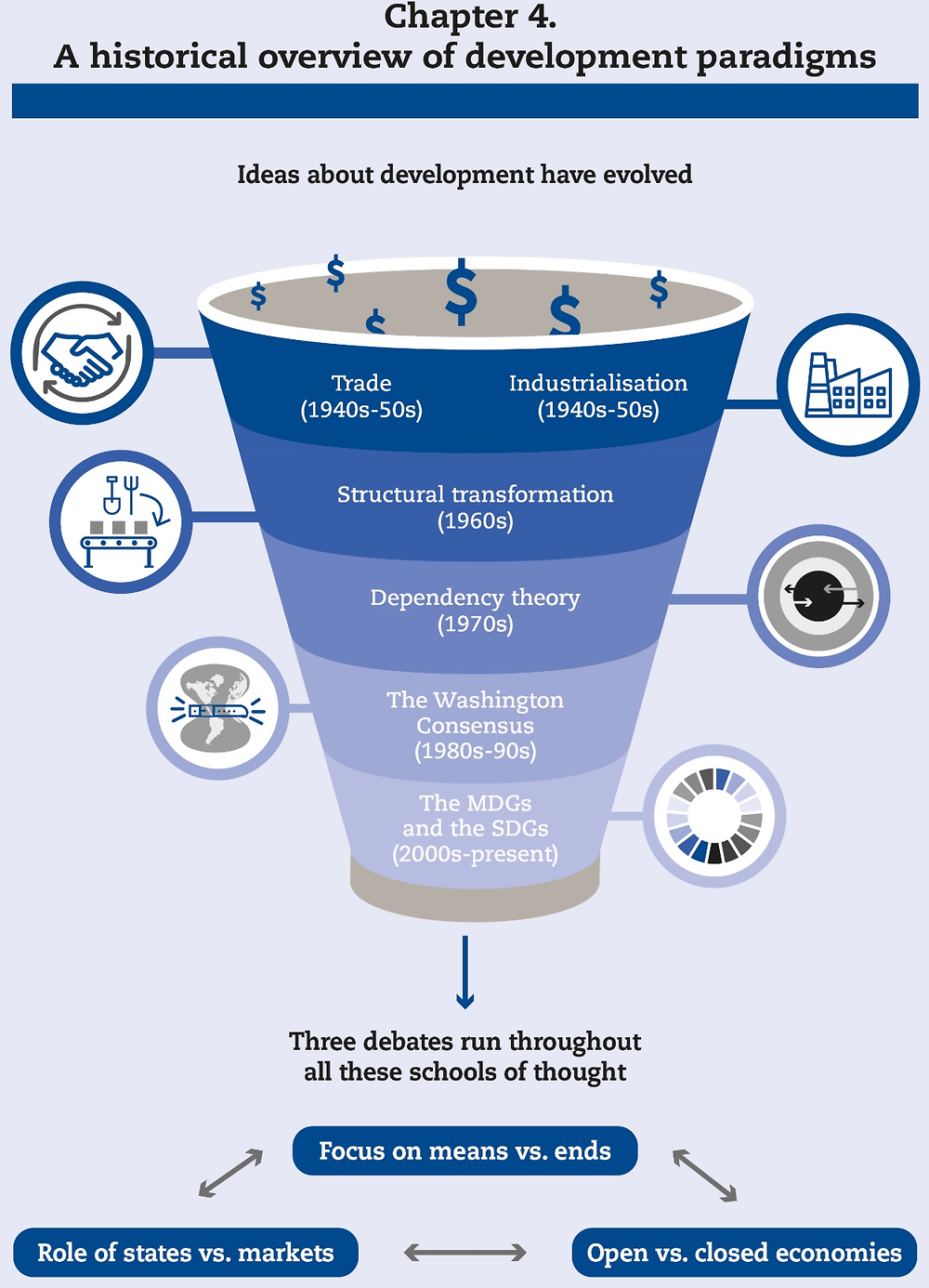

Oecd Ilibrary Home

Http Shodhganga Inflibnet Ac In Jspui Bitstream 10603 150192 16 11 Chapter 205 Pdf

Understanding Notice Under Section 143 1

Https Library Unt Edu Gpo Acir Reports Policy A 31 1 Pdf

Income Tax Benefits On Nps Explained In 5 Points

Interim Budget 2019 Income Tax Rates Exemptions Deductions And